By Dare Akogun

Claim: Mali has become the first African country to pay off its debts completely.

Verdict: False. While the country may have cleared $332 million in internal arrears, its public debt remains high. The claim exaggerates a partial debt payment into a complete economic redemption narrative.

Full Text

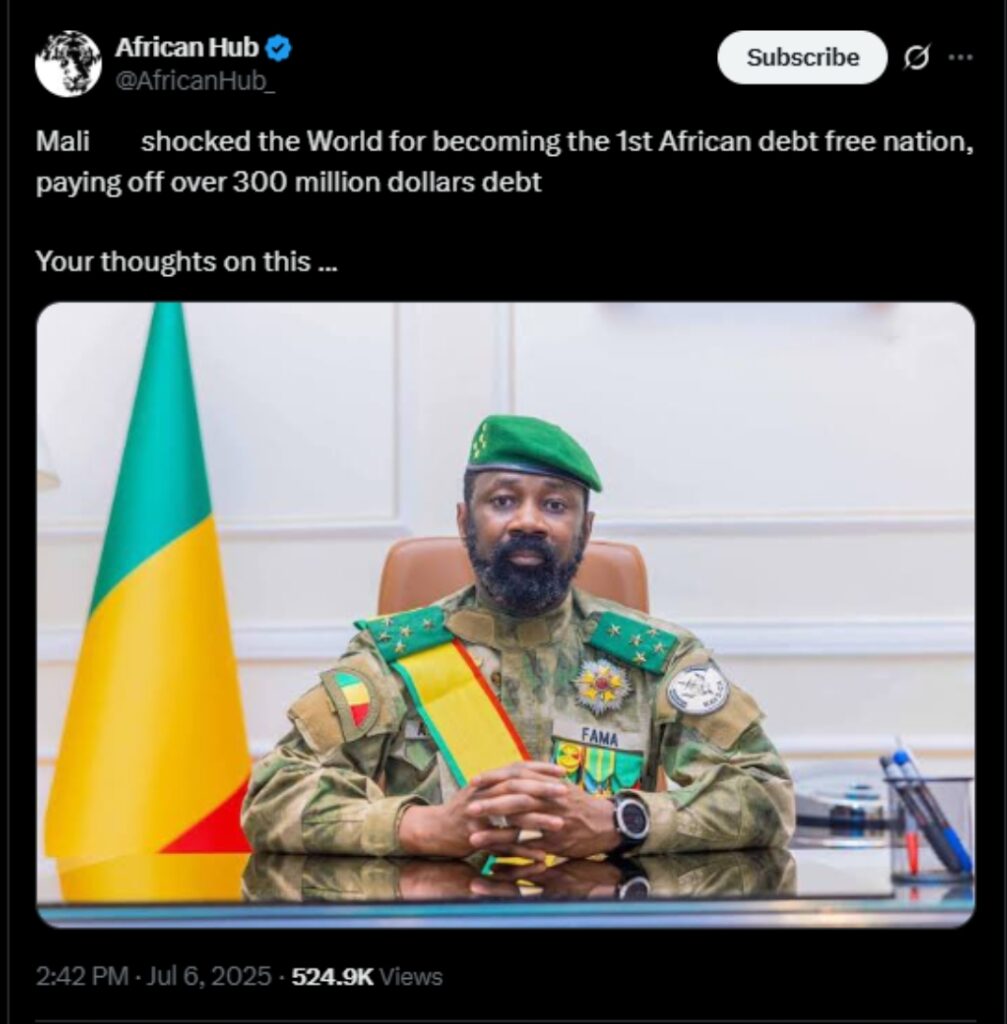

An X user @African Hub_ shared a post claiming that Mali has become the first African country to completely pay off its debt, stating that it has cleared over $300 million.

As of July 10, 2025, the post had garnered 524,000 views, 32,000 likes, 5,500 reposts, and approximately 779 comments.

The claim, which features images of Mali’s military president, Assimi Goïta, was first posted on Nov. 10, 2024, with over a million views archived here, and has gained traction among pro-regime supporters and West African social media users.

The post, which was shared by some other social media users around November 2024 on Facebook and YouTube, here, here, and here, sparked praise from those who believe Mali’s military-led government is financially liberating the country.

DUBAWA decided to verify the claim’s accuracy because it is gaining traction across various online platforms, which is in line with our core mandate (to promote truth and accuracy in public discourse, curb the spread of misinformation, and ensure the media space remains credible and reliable).

Verification

According to a recent report by CNBC Africa, Mali owes more than $94 million to the entity managing a dam that also provides power to Senegal and Mauritania. The debt has become “a question of life and death” for the dam’s ability to continue operating.

The report states that Mali currently owes “an enormous amount of more than 54 billion CFA francs ($94.12 million) to SOGEM, the entity that manages Manantali and several other projects, according to an April 25 letter from SOGEM to the director-general of Energie du Mali, Mali’s electric utility.”

Also, an October 2024 report by Reuters revealed that Mali’s Economy Minister, Alousseni Sanou, stated that the country would settle 200 billion CFA francs, equivalent to $332 million of its internal debt, within the following week after the announcement.

Although the minister did not state the overall figure of Mali’s internal debt, “200 billion CFA francs ($332 million) of its internal debt” clearly shows that the payment is a fraction of the entire debt.

According to an IMF report, despite the $332 million repayment, Mali still carries a substantial domestic and external debt burden. In 2025 alone, Mali plans to repay 918.4 billion CFA francs (about USD 1.5 billion) in outstanding obligations.

A report by Statista reveals that the national debt in Mali is projected to continuously increase between 2024 and 2029 by 4.4 billion U.S. dollars (+36.64 per cent).

In 2022, Mali’s public debt stood at 51.7% of its Gross Domestic Product (GDP), a significant rise from the decade-long average of 38.3% between 2012 and 2022.

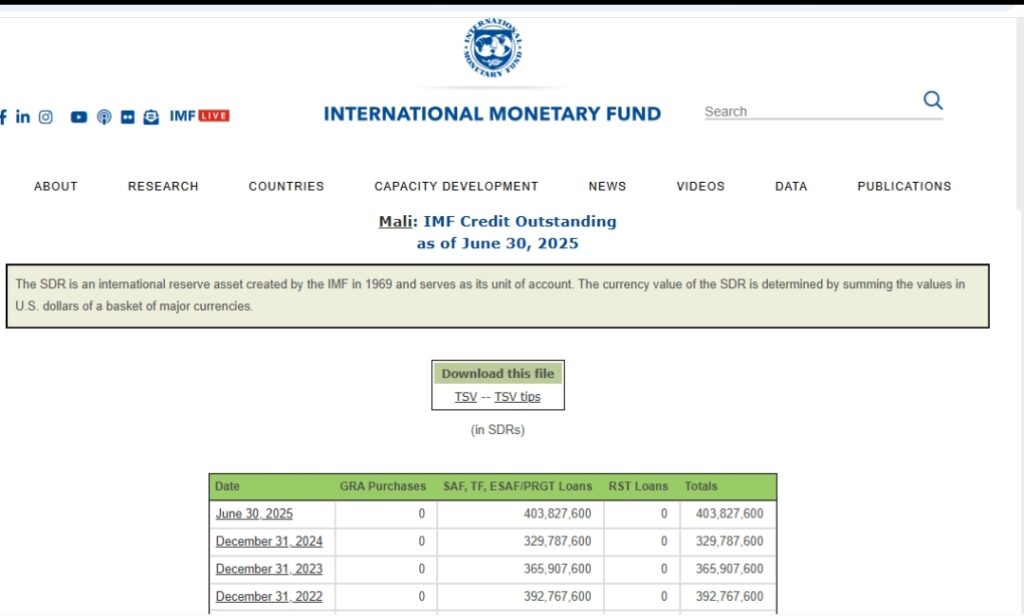

As of July 2025, the IMF listed Mali among countries on its website with outstanding credit in a table showing the movement from July 1, 2025, to July 9, 2025.

Screenshot of Mali’s credit outstanding to the IMF as of June 30, 2025. Source: IMF website

According to UNCTAD, Africa’s public debt reached $1.8 trillion in 2022. While this is a smaller proportion than other developing regions, the rate of increase in African debt is concerning, rising by 183% since 2010.

Many African countries face substantial debt servicing costs, which are interest payments and principal payments on their outstanding debt. For example, in 2021, according to African Business, Sub-Saharan African countries paid around $84 billion in debt service costs.

The IMF and World Bank data consistently show that all African nations carry some level of public debt, with ratios varying (e.g., Egypt at 90% of GDP and Nigeria at 40%).

It is also noteworthy that this X account is notorious for sharing misleading information, as shown in this DUBAWA report.

Conclusion

The assertion that Mali is now debt-free is misleading and false. While the country may have cleared $332 million in internal arrears, its overall public debt remains high. The claim exaggerates a partial debt payment into a complete economic redemption narrative.